Unpacking the Vancouver Real Estate Market and Its Effects on Businesses

When thinking of Vancouver, the stunning skyline and majestic natural beauty might be the first things that come to mind. However, behind this picturesque facade lies an ever-evolving real estate market filled with opportunities and challenges. As we delve deeper into Vancouver’s real estate landscape, we will uncover the intricate connections between the housing market and local businesses, the role of government policies and regulations, and the inspiring stories of those who have successfully navigated this complex terrain.

In this blog post, we’ll explore the impact of the Vancouver real estate market and its effects on businesses, understand the significance of government policies and regulations, highlight the opportunities and challenges for the real estate industry, and learn from the experiences of those who have successfully adapted to the high costs, embraced collaborative spaces, and overcome regulatory hurdles. So buckle up and prepare for an enlightening journey through Vancouver’s real estate market.

Short Summary

- Vancouver’s real estate market directly impacts small businesses, employee housing affordability and commercial trends.

- Government policies and regulations influence zoning, development restrictions, property taxes and housing affordability in Vancouver.

- Businesses can navigate the market uncertainty by diversifying their portfolio, staying informed of emerging trends & leveraging cost savings through collaborative spaces.

The Impact of Vancouver’s Housing Market on Local Businesses

Vancouver’s housing market is witnessing record-breaking sales and sky-high home prices, which have a domino effect on local businesses. The city’s real estate landscape presents a double-edged sword for entrepreneurs and workers alike, as the escalating housing prices pose challenges for small business owners, employee housing affordability, and commercial real estate trends. With Vancouver ranking as the second most unaffordable city out of 325 worldwide, the consequences of this housing conundrum reverberate throughout the local economy.

Despite the sensational headlines and staggering statistics, it’s essential to remember that behind every number lies a human story. The impact of Metro Vancouver’s housing market on local businesses is felt most acutely by those who strive to make a living in this bustling metropolis.

In the following sections, we’ll delve into the effects on small business owners, employee housing affordability, and commercial real estate trends, painting a vivid picture of the challenges and opportunities ahead for Vancouver’s real estate industry.

Effects on Small Business Owners

The high property costs in Metro Vancouver have a rippling effect on small business owners, as it reduces the desire to acquire new premises, hinders recruitment and retention of personnel, and intensifies competition in the rental market. The soaring real estate prices make it increasingly difficult for small business owners to procure commercial space, as the cost of purchasing or renting commercial space usually exceeds that of residential space.

To adapt to these high costs, small business owners can explore innovative strategies to decrease overhead costs, such as negotiating for reduced rent or cutting energy expenses. Moreover, they can seek ways to boost revenue by offering new services or products or broadening their customer base.

Resources and support provided by the Canadian Real Estate Association, including the real estate board, can help real estate professionals navigate the challenges of the market.

Employee Housing Affordability

The scarcity of affordable housing and well-paying jobs presents a significant challenge for workers in Vancouver, as escalating housing costs make it difficult for employees to find affordable housing, particularly for families seeking three-bedroom units. This affordability crisis has been a matter of concern for many years, and the rising house prices have made it increasingly difficult for individuals and families to find affordable housing options.

The increasing inequality gap in affordable housing presents a substantial difficulty for households in British Columbia who cannot afford the rental and ownership housing markets. A knowledgeable real estate agent can play a crucial role in helping clients navigate the complex housing market and find suitable housing options within their budget.

Commercial Real Estate Trends

In the commercial real estate sector, current trends include:

- Overall capitalization rates, which measure the rate of return on a real estate investment, are calculated by dividing the net operating income of a property by its purchase price, influenced by interest rates.

- Office and industrial vacancy rates.

- The demand for high-tech properties in Metro Vancouver.

Office and industrial vacancy rates assess the quantity of available space in a particular region, which is used to evaluate the requirement for office and industrial space in a specific market. Furthermore, there is a growing demand for high-tech properties as businesses seek ways to reduce costs and maximize efficiency. High-tech properties typically feature advanced technology, such as automated systems, which can be beneficial in terms of cost-effectiveness and productivity.

The Role of Government Policies and Regulations

Government policies and regulations significantly shape Vancouver’s real estate market, as they govern zoning and development restrictions, property taxes, and housing affordability. The City of Vancouver, for instance, aims to expand residential zoning to accommodate the projected population growth of one million or more inhabitants by 2041.

As we examine the role of government policies and regulations, it’s crucial to understand the implications of these rules on the housing market and local businesses. The following sections will discuss zoning and development restrictions, property taxes, and the measures being implemented to address housing affordability.

Zoning and Development Restrictions

The Zoning and Development By-law governs zoning and development restrictions in Vancouver. This by-law regulates various aspects of land use and building design, including:

- Land use

- Density

- Floor area

- Form

- Placement

- Design of buildings in the city

However, some critics argue that the city’s rezoning and building plans lack transparency and are driven by those who stand to gain financially.

To address the housing problem in Vancouver, Elizabeth Murphy suggests that the solution lies not in increasing the number of housing units but rather in constructing housing units better suited to the needs of metro Vancouverites. According to her, the current units available are too expensive and serve to make Vancouver an attractive investment commodity rather than a planned community.

Property Taxes

Property taxes in Vancouver fluctuate based on the assessed value of the property, with the general purpose tax levy ranging from $1.53131 to $1.63321 per $1,000 of taxable value and the provincial school tax ranging from $0.84961 to $0.96661 per $1,000 of taxable value. These taxes can significantly impact residential and commercial property owners, influencing overall affordability.

Recent increases in property taxes have been a cause for concern, with an average increase of 6.35% in 2022 and 5% in 2021. Businesses must be aware of these taxes and the potential for further increases, as they can affect the cost of conducting business in the city.

Addressing Housing Affordability

Addressing housing affordability is a pressing need in Vancouver’s real estate market. Government initiatives aim to tackle this issue by:

- Adding and protecting market rental housing

- Curbing speculative demand

- We are implementing laws to protect consumers in the real estate market, such as cooling-off periods.

However, these initiatives face challenges in implementation and effectiveness. A comprehensive solution to Canada’s housing affordability crisis requires a multi-faceted approach, including increasing supply and promoting sustainable development.

As we continue exploring the intricacies of Vancouver’s real estate market, it’s important to consider the role of government policies and regulations in shaping the landscape.

Opportunities and Challenges for Vancouver’s Real Estate Industry

Vancouver’s Vancouver real estate industry faces both opportunities and challenges as it grapples with high prices, market uncertainty, and evolving government policies. Some of the key opportunities include growth in prop-tech, the implementation of ESG strategies, and the ability to navigate market uncertainty. On the other hand, challenges include zoning and development regulations, property taxes, and addressing housing affordability.

As we venture further into the dynamic world of Vancouver’s real estate industry, let us examine these opportunities and challenges in greater detail. In the following sections, we’ll discuss prop-tech growth, the adoption of ESG strategies, and the strategies real estate professionals employ to navigate market uncertainty.

Growth in Proptech

Proptech, or property technology, is a rapidly growing sector that offers innovative solutions to streamline processes and improve efficiency in the real estate industry. The proptech industry in Vancouver has witnessed remarkable growth, with more than 70 proptech companies established in 2020 and 2021 alone.

Vancouver’s burgeoning tech environment and flourishing real estate sector provide many opportunities for prop-tech invention and investment. As businesses and real estate professionals continue to integrate prop-tech into their operations, the potential for improved efficiency, cost savings, and enhanced customer experiences are boundless.

ESG Strategies

Environmental, Social, and Governance (ESG) strategies are increasingly important in the real estate industry, as they attract investment and promote sustainable development. For real estate companies, having a robust ESG track record can provide an advantage in securing investments from institutional players and procuring novel sources of capital that are increasing in prevalence in Canada.

However, implementing ESG strategies requires commitment and long-term planning. As the real estate industry evolves, businesses must be prepared to adapt and incorporate ESG considerations, such as environmental sustainability and net-zero emissions, into their operations and investment strategies.

Navigating Market Uncertainty

Market uncertainty is an inherent part of the real estate industry, as it is influenced by factors such as interest rate fluctuations, supply chain disruptions, and geopolitical events. To navigate these uncertainties, real estate professionals must adopt strategies that involve diversifying their portfolio, staying true to their goals and objectives, considering the purchase of fixer-uppers or properties with potential for improvement, staying informed about government policies and regulations, and paying attention to emerging trends and investment prospects in Vancouver’s real estate market, including the benchmark price.

By employing these strategies, real estate professionals can mitigate risks, capitalize on growth opportunities, and maintain focus during uncertain times. As the Vancouver real estate market evolves, adaptability, resilience, and innovation will be key to thriving in this dynamic environment.

Case Studies: Success Stories and Lessons Learned

Throughout our exploration of Vancouver’s real estate market, we have encountered numerous success stories and lessons learned from businesses and individuals who have adapted to high costs, embraced collaborative spaces, and overcome regulatory hurdles. These case studies serve as invaluable sources of inspiration and guidance for those navigating the complex landscape of Vancouver’s real estate market.

In the following sections, we will delve into the experiences of those who have successfully adapted to high costs, embraced the potential of collaborative spaces, and navigated the intricate maze of zoning and development restrictions. Through their stories, we can glean insights and strategies that can be applied to our real estate journeys.

Adapting to High Costs

Businesses that have successfully adapted to high costs in Vancouver’s real estate market have focused on efficiency, innovation, and strategic planning. These businesses have reduced expenses and remain competitive by streamlining processes, cutting overhead costs, and utilizing technology.

Additionally, they have investigated new markets, diversified their investments, and examined alternative financing options to boost revenue and mitigate risks. By employing these strategies, businesses can survive and thrive in the face of escalating costs in Vancouver’s real estate market.

Collaborative Spaces

Collaborative spaces offer flexible solutions for businesses seeking affordable and adaptable work environments in Vancouver’s real estate industry. Coworking spaces, collaborative home ownership, and creative workspaces like The Woodlands in Oakridge Park exemplify the potential of these innovative spaces.

The benefits of collaborative spaces include flexibility, affordability, and adaptability, as they can be utilized for multiple purposes, ranging from office space to creative workspaces. As the demand for such spaces continues to grow, they present an opportunity for businesses to reduce costs while fostering collaboration and innovation.

Overcoming Regulatory Hurdles

Overcoming regulatory hurdles in Vancouver’s real estate market requires persistence, collaboration, and creative problem-solving. Strategies for navigating these obstacles may include amending rules in the housing market, altering local zoning ordinances to construct dense, multi-unit dwellings in urban areas, and promoting social purpose real estate as a sustainability approach for not-for-profit entities.

By embracing these strategies, businesses and individuals can successfully navigate the complex regulatory landscape of Vancouver’s real estate market, unlocking new opportunities for growth and development with the help of Vancouver real estate agents.

Summary

Throughout our journey into Vancouver’s real estate market, we have discovered the intricate connections between the housing market and local businesses, the role of government policies and regulations, and the inspiring stories of those who have successfully navigated this complex terrain. From the challenges faced by small business owners and employees seeking affordable housing to the opportunities presented by prop-tech, ESG strategies, and collaborative spaces, the Vancouver real estate market is a dynamic and ever-evolving landscape.

As we conclude our exploration, let us remember that adaptability, resilience, and innovation are the key to success in this market. By embracing these qualities and learning from the experiences of those who have come before us, we can chart our paths to success in the vibrant and challenging world of Vancouver’s real estate market.

Frequently Asked Questions

What is happening to the housing market in Vancouver?

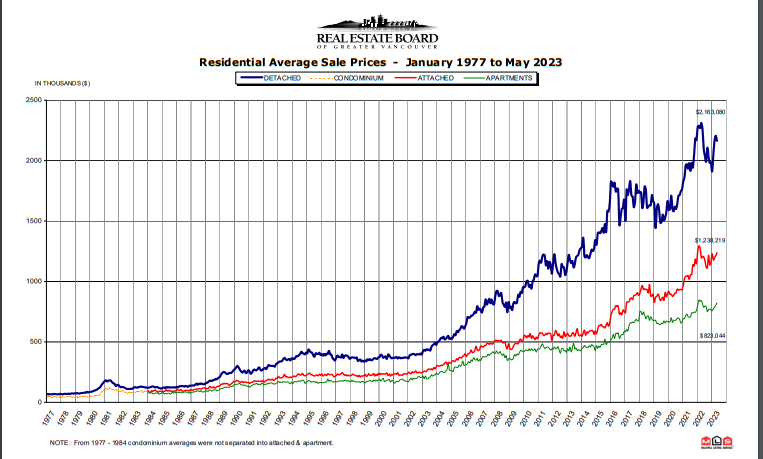

The housing market in Vancouver is showing signs of a decrease, with benchmark home prices dropping 5.6% year-over-year to $1,188,000 in May 2023 and a 4.1% drop from the all-time high of $1,262,600 in April 2022.

The average detached home price increased by 6.0% year-over-year to $2.16M, and the attached home average price increased by 4.6% year-over-year to $1.23M.

What is the real estate prediction for Vancouver in 2023?

According to our forecast, home prices in Metro Vancouver will increase by 6% or more by the end of 2023.

This suggests that real estate in Vancouver will remain a hot commodity in 2023.

What are the main challenges small business owners face in Vancouver’s real estate market?

Small business owners in Vancouver’s real estate market face the challenge of reduced desirability of acquiring new premises, difficulty recruiting and retaining personnel, and increased competition in the rental market due to high property costs.

The high cost of property has made it difficult for small businesses to acquire new premises and has also made it difficult to recruit and retain personnel. This has led to increased competition in the rental market, making it even more difficult for small businesses to find suitable premises.

To do so, the user must have an online account.

How can businesses adapt to high costs in Vancouver’s real estate market?

Businesses can adapt to high costs in Vancouver’s real estate market by focusing on efficiency, streamlining processes, cutting overhead costs, utilizing technology, investigating new markets and diversifying investments.

These strategies can help businesses remain competitive and profitable in a challenging market. They can also help businesses reduce their reliance on expensive real estate and diversify their investments.

By focusing on efficiency, businesses can reduce costs and increase profits. Streamlining the streamlining process.

What role do government policies and regulations play in Vancouver’s real estate market?

Government policies and regulations play a significant role in Vancouver’s real estate market, with various zoning and development restrictions, property taxes and initiatives to tackle housing affordability all having an effect.

These policies and regulations have a direct impact on the availability and cost of housing in the city and can have a significant effect on the market. For example, zoning restrictions can limit the number of new housing units built in certain areas. In contrast, property restrictions can limit the number of new housing units built in certain areas.